Perceived Ease Of Use Internet Banking

Surprising results were found.

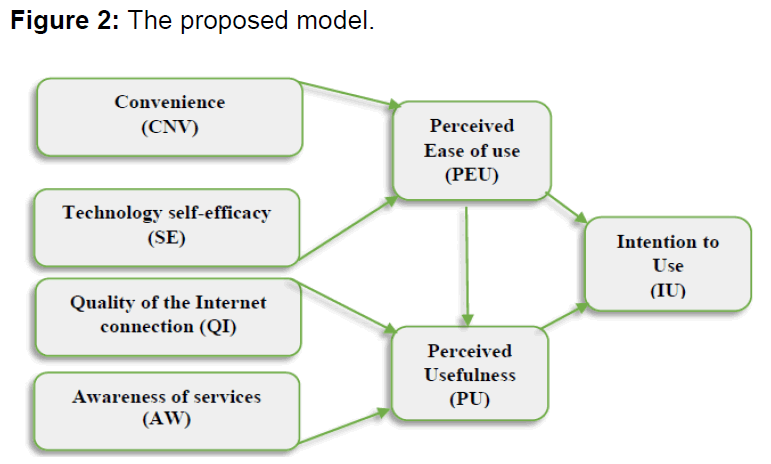

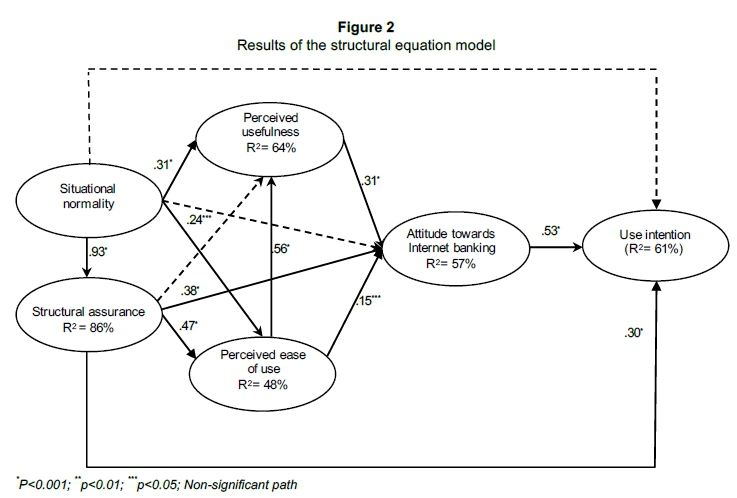

Perceived ease of use internet banking. In this study we first identify two dimensions. The results confirm that trust increases if users perceive online banking to be useful whereas perceived ease of use fails to predict jordanians intention to accept and use online banking. Examining the role of usefulness ease of use perceived risk and self efficacy journal of enterprise information management vol. The surprising factor in this was that majority of tam related research has concluded that pu is the ruling factor over peou.

In recent years a smart phone has become a useful platform to easily access banking services. 2003 showed that perceived ease of use has a significant impact on the development of initial willingness to use internet banking. This study further offers a marketing insight for managers to effectively deploy online system and service. Concluded that perceived ease of use was a significant measure in the development of people s intention to use wireless finance.

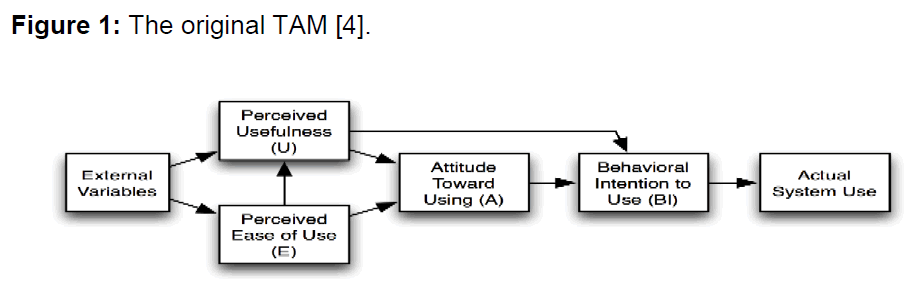

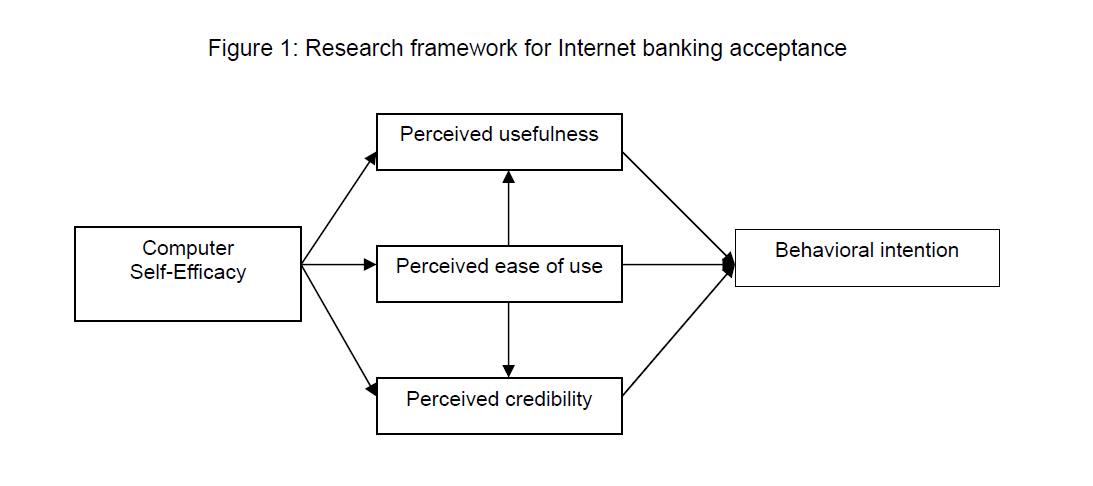

According to the technology acceptance model tam perceived ease of use and perceived usefulness constructs are believed to be fundamental in determining the acceptance and use of various it. Perceived ease of use and perceived credibility were more significant than perceived usefulness in predicting the behavioural intention to use internet banking. The perceived ease of use which is a combination of convenience provided to those with easy internet access the availability of secure high standard electronic banking functionality and the necessity of banking services. However compared to regular internet banking using a personal computer the adoption of a smart phone for internet banking might be more vulnerable with regard to security.

The statistical results show that relative advantages trust and perceived ease of use are more important and critical to customer s intention of online banking adoption. Security and usability and empirically test their role as determinants that. These beliefs may however not fully explain the user s behavior toward newly emerging it such as internet banking.